Investment Universe

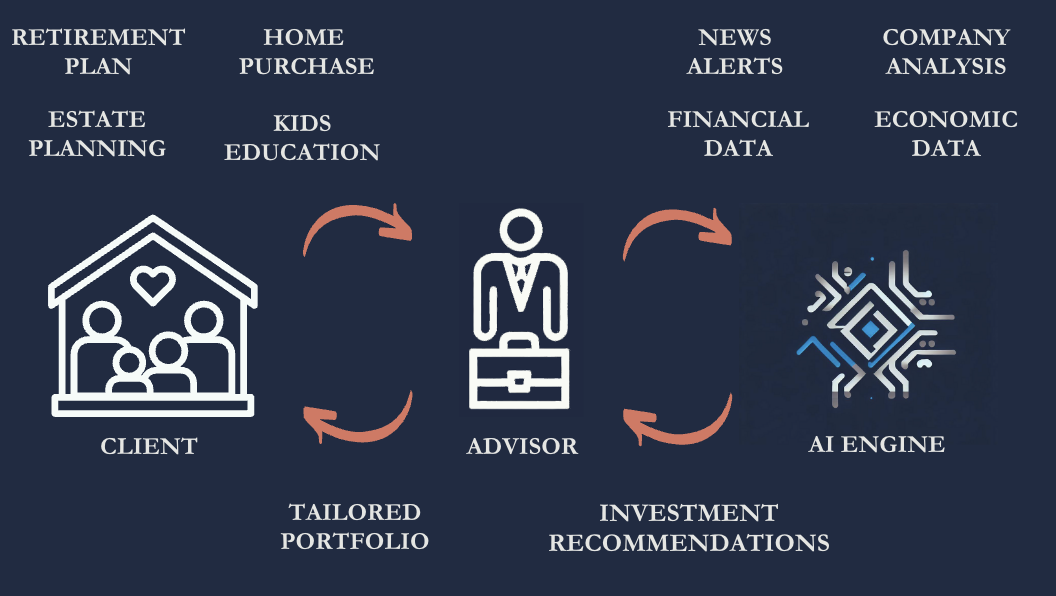

The AI engine can scan the entire investible universe in seconds.

High Quality Filter

Utilize prompt engineering across several AI models to filter for specific levels of sales and earnings growth, profitability, and other high quality metrics.

Financial Stability Filter

Reduce investible universe to those companies which have shown stable growth and reduced earnings volatility. Also quality of balance sheet.

Business Characteristics Filter

AI can quickly analyze a company's business and industry. Filter for competitive threats, brand recognition, and pricing power (i.e. "wide moat").

Price and Valuation Filter

Analyze vlauation vs. peers, industry, and vs. history to determine if current valuation is reasonable.

Our process then allocates these opportunities across sectors and based on macroeconomic data which the models are constantly evaluating such as financial conditions, geopolitical events, and economic data. Equity and bond mix is determined by client risk tolerance levels.